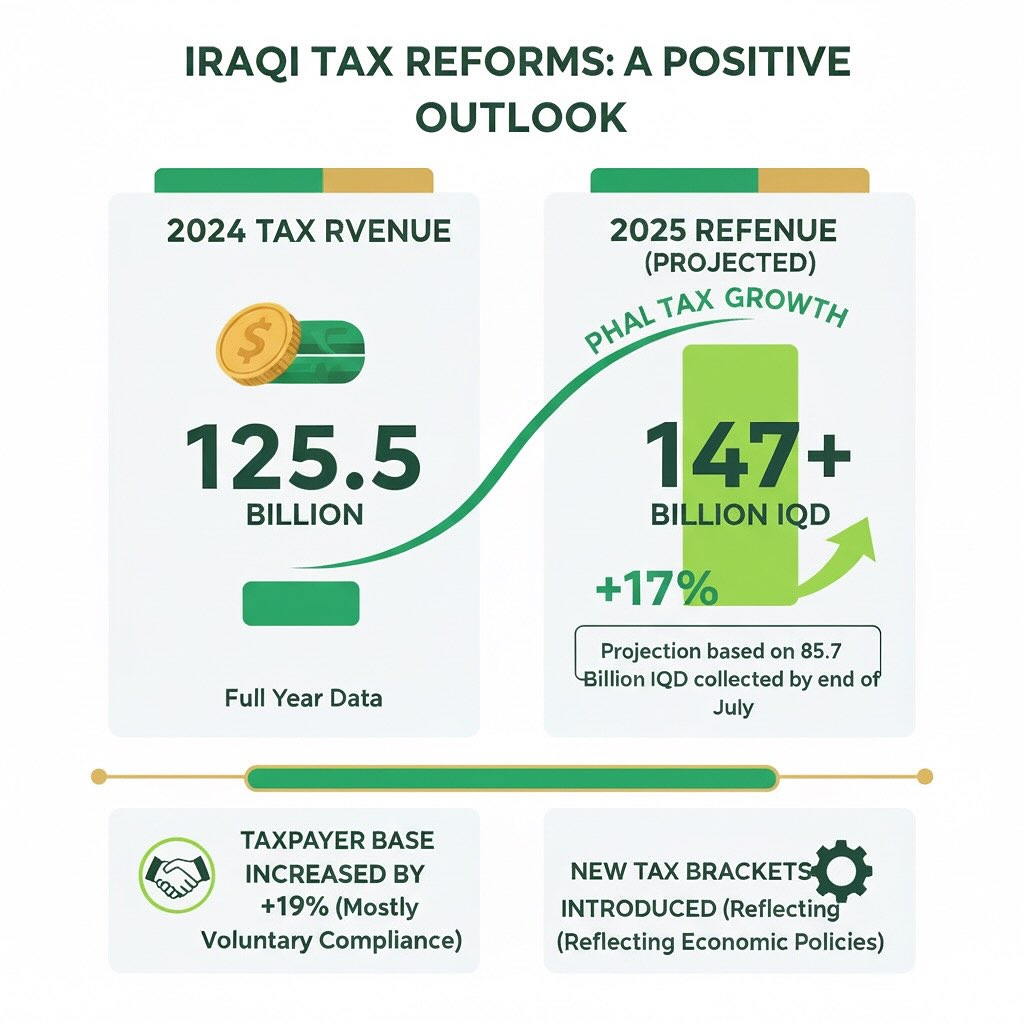

The figures show that tax revenues from professionals rose from 125.5 billion IQD in 2024 to projected revenues nearing 147 billion IQD in 2025 — an increase of approximately 17%. The number of taxpayers also grew by more than 19%, most of them through voluntary compliance. These are early signs that tax reforms are beginning to bear fruit.

However, behind these numbers lies a more complex reality. The business environment remains burdened by accumulated municipal fees, which have effectively become a form of “shadow tax,” straining small and medium-sized professions and pushing many towards evasion just to stay operational.

More concerning is that fiscal policy lacks adequate support from sectoral ministries. Private hospitals, clinics, and educational institutes are still outside the scope of actual tax assessment, while medical warehouses and pharmacies have not been taxed in a way that reflects their true market size—nor have several other economic activities. This lack of coordination undermines one of the most vital economic tools: taxes as a means for development, not just revenue collection.

The real test lies not only in boosting numbers but in transforming taxation into a new social contract: a simpler business environment, fewer overlapping fees, and stronger government partnerships to reinforce fiscal policy. Sectoral agencies can play a key role by offering incentives to compliant taxpayers—such as simplifying registration procedures, granting permits, or other support measures. Especially when we consider that the true purpose of taxation is to support and facilitate economic activity.