Data up to June 2025 reveals a significant shift in Iraq’s tax policy. After decades of relying on limited sectors—such as doctors, contractors, and car owners—the state has begun including new sectors that operated for years outside the tax umbrella. This change reflects not only an increase in numbers but also the beginning of a fairer redistribution of tax burdens across various economic activities.

The Big Picture

-

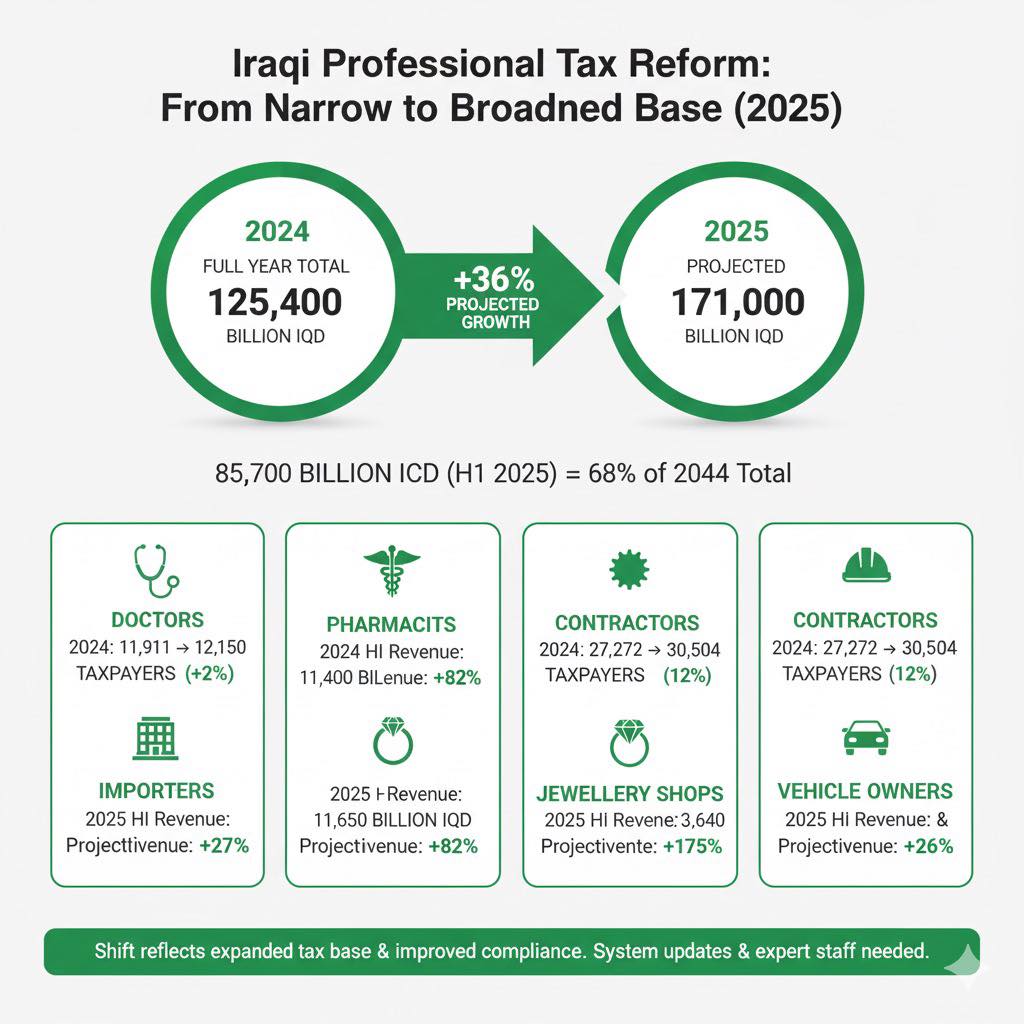

Total revenues in 2024: 125.4 billion IQD

-

Total revenues until June 2025: 85.7 billion IQD

This half-year revenue represents about 68% of the total for 2024. If this pace continues until year-end, revenues are expected to reach 171 trillion IQD, an increase of nearly 36% compared to the previous year.

Traditional Sectors: Between Stability and Need for Reform

The major categories that have formed the backbone of tax collection still show relative stability with varied growth. However, the gap between the real economic activity and actual revenues indicates a need to update systems and strengthen the General Tax Authority’s capabilities.

-

Doctors: Numbers increased from 11,911 in 2024 to 12,150 in 2025 (+2%). Half-year revenues reached 5.9 billion IQD, expected to hit 12 billion by year-end, compared to 9.4 billion in 2024 (+27%). This sector requires more precise mechanisms to improve compliance.

-

Pharmacists: Half-year revenues were 11.4 billion IQD, equivalent to 94% of the full 2024 revenue (12.1 billion). The annual projection points to 22 billion IQD, an increase of about +82%. Still, there is a need to build systems that reduce the gap between market size and official figures.

-

Contractors: Their numbers rose to 30,504, with revenues expected to reach 7 billion IQD this year, compared to 4.8 billion in 2024 (+31%).

-

Real Estate Brokers: Earned 476 million IQD in the first half, half of their 2024 total (958 million). If the pace continues, revenues may exceed 1 billion IQD for the first time (+4%).

-

Importers: Half-year revenues reached 1.65 billion IQD, compared to 1.18 billion in 2024 (+40%). Although registered numbers dropped due to many being reclassified as companies, revenues are likely to double the previous figure.

-

Jewelry Shops (Gold): Half-year revenues were 3.64 billion IQD, compared to 2.54 billion in 2024. If this trend continues, they will surpass 7 billion IQD (+175%). Despite growth, the sector remains underrepresented compared to its actual economic size.

-

Car Owners: Still the backbone of tax collection, with 1.91 million taxpayers. Half-year revenues reached 32.2 billion IQD, about 64% of the 2024 total (50.6 billion). Annual projections put them at 64 billion IQD (+26%).

Relative Stability Is Not Enough

Despite growth, there remains a clear gap between the economic reality and revenues, necessitating updates to auditing tools, digitalization, and building specialized staff capable of increasing tax efficiency.